how much federal income tax comes out of paycheck

The FICA tax rate for 2018 is 765 percent which is comprised of 62 percent for Social Security taxes and 145 percent for medicare tax. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might.

New Tax Law Take Home Pay Calculator For 75 000 Salary

What is the percentage that is taken out of a paycheck.

. Your employer will also pay that same. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. 10 12 22 24 32 35 and 37.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. To do a Paycheck Checkup to make sure they have the right amount of. The first 20000 of that would be taxed at 10 or 2000.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Overview Of Georgia Taxes. New York paycheck calculator.

These are the rates for. Income over 5 million is already. Federal income taxes are paid in tiers.

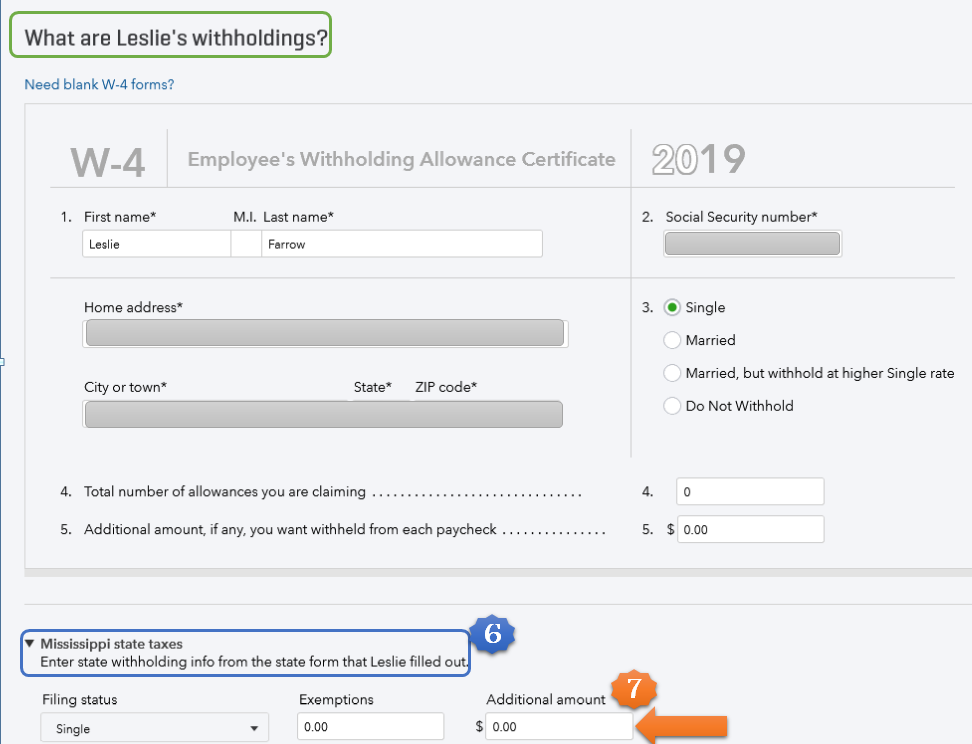

Your bracket depends on your taxable income and filing status. The amount withheld per paycheck. Just enter the wages.

In fact your employer would not withhold any tax at all. Single taxpayers who earn less than 75000 a year and couples who file. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

So far in FY 0 individual income taxes have accounted for 0 of total revenue while Social Security and Medicare taxes made up another 0. Use ADP s New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The next 30000 would be taxed at 20 or 6000.

Government revenue also comes from. Peach State residents who make more money. The social security and medicare taxes come to 7650 for a total of 29650.

How much California residents will receive is based on their income tax-filing status and household size. If this is the case. The federal government collects your income tax payments.

NJ Taxation Effective January 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022. You pay the tax on only the first 147000 of.

If youre considered an independent contractor there would be no federal tax withheld from your pay. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. There are seven federal tax brackets for the 2021 tax year.

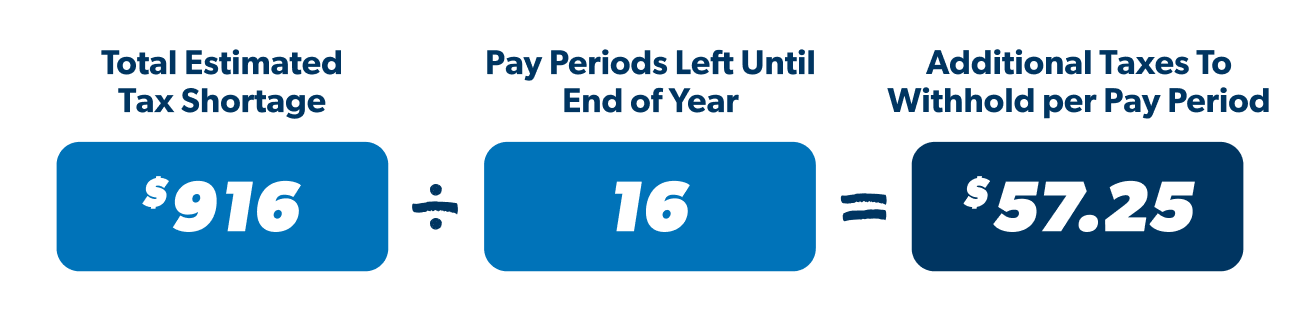

A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. Taxes Taken Out Of Paycheck Everything You Need To Know from. The final 25000 of your income would be taxed at 30 or 7500.

A short-term for Federal Insurance Contributions Act FICA taxes serves as social security and Medicare taxes paid by each individual working under a US-registered company. Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. For a single filer the first 9875 you earn is taxed at 10.

How To Calculate Your Tax Withholding Ramseysolutions Com

Visualizing Taxes Deducted From Your Paycheck In Every State

How Much In Federal Taxes Is Taken Out Of Paychecks

Paycheck Calculator Online For Per Pay Period Create W 4

Free Paycheck Calculator Hourly Salary Smartasset

Decoding A Paycheck Benjamin Talks

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Anatomy Of A Paycheck Understanding Your Deductions Fidelity

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

Solved Can I Deduct Extra Federal Income Tax From A Paycheck

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Understanding Your Paycheck Credit Com

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

Irs New Tax Withholding Tables

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Withholding Changes Can Boost Your Paycheck Kiplinger

Part 2 Salary Vs Actual Pay An Actual Paycheck In California Fashionfoodiela