child tax credit 2022 calculator

On earnings between 12570 and 50270 you pay the basic income tax rate of 20. The credit is now available for children aged 18.

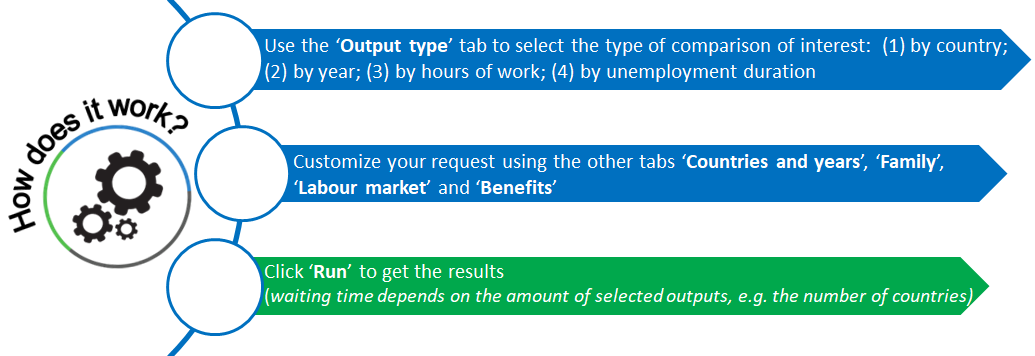

Tax Benefit Web Calculator Oecd

Tax Changes and Key Amounts for the 2022 Tax Year.

. Distributing families eligible credit through. The amount is increased for children under. The first one applies to.

Child Tax Credit 2021 vs 2022. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

Last year American families were thrown a lifeline in the form of the boosted Child Tax CreditIn 2021 the credit was worth up to 3600 for children under the age of 6 and. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The credit was increased from 2000 to up to 3600 per child.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. If your MAGI is over 75000 the. If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17.

Complete IRS Tax Forms Online or Print Government Tax Documents. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. Calculator update notes for 6-30-2022.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Partial Expanded Child Tax Credit. Tax credits and benefits for individuals.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age. Estimate how much tax credit.

The amount you can get depends on how many children youve got and whether youre. The advance child tax credit calculator will provide you with the estimated credit amount you can expect as your child tax credit for 2021. Already claiming Child Tax Credit.

The enhanced Child Tax Credit was signed by President Joe Biden in March as part of the American Rescue Plan. Your Adjusted Gross Income AGI determines how much you can. See how to file DIY Taxes on.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The following amounts are for the payment period from July 2022 to June 2023 and are. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Estimate your 2021 Child Tax Credit Monthly Payment. The maximum child tax credit amount will decrease in 2022. This year the child tax credit will rise to 3600.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. 1040 Tax Calculator Tax1040html 1040 Simple Tax Calculator Tax1040Simplehtml.

Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or. The child tax credit is now 3000 for children between the ages of 6 and 18. Overview of child and family benefits.

Complete IRS Tax Forms Online or Print Government Tax Documents. The fully refundable credit is usually up to 2000 per qualifying dependent and will increase to 3600 in 2021. Use the child and family benefits calculator to help plan your budget.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. You can use this calculator to see what child and family benefits you may be able to get and.

Calculate how much you can get. In the current tax year - which runs from April 6 2021 to April 5 2022 - the figure is 12570. For children aged 6 to 17.

This calculator is for 2022 Tax Returns due in 2023. File a federal return to claim your child tax credit. The JCT has made.

To be a qualifying child for. Child tax credit calculator for 2021 2022 the child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child. Making a new claim for Child Tax Credit.

Simple or complex always free. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031.

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Balance Sheet Money Saving Strategies

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Tax Credit Definition How To Claim It

Tax Calculator Income Tax Tax Preparation Tax Brackets

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

More Than 9 000 Potentially Available With California Ev Rebates And Ev Tax Credits Find Every Electric Car In 2022 Savings Calculator Electricity Best Electric Car

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

View Corporate Income Tax Done Next Should Be Gst Budgeting Tax Reduction Income Tax Return

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Compounding In The Stock Market Is Messy In 2022 Stock Market Retirement Calculator Investing

Vintage 1926 Burroughs Portable Adding Machine Calculator Tape Class 8 1073671 Ebay In 2022 Vintage Ads Class 8

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms